Last Update: February 21, 2022

Multiple linear regression is used to model linear relationship between one dependent or explained variable and two or more independent or explanatory variables

. Variable

is also known as target or response feature and variables

are also known as predictor features.

As example, we can fit a three-variable multiple linear regression model with formula . Notice that we are using ˄ or hat character in formula notation because they are estimates. Regression fitted values

are the estimated

values. Estimated constant coefficient

is the

value when

and

. Estimated partial regression coefficient

is the estimated change in

when

changes in one unit while holding

constant. Similarly, estimated partial regression coefficient

is the estimated change in

when

changes in one unit while holding

constant.

Model fitting can be done using ordinary least squares method with formula . This method minimizes the sum of squared regression residuals

. Regression residuals

with formula

are the estimated differences between actual

and fitted

values.

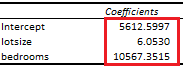

Below, we find an example of estimated coefficients from multiple linear regression of house price explained by its lot size and number of bedrooms [1].

Courses

My online courses are hosted at Teachable website.

For more details on this concept, you can view my Linear Regression Courses.

References

[1] Data Description: Sales prices of houses sold in the city of Windsor, Canada, during July, August and September, 1987.

Original Source: Anglin, P., and Gencay, R. (1996). Semiparametric Estimation of a Hedonic Price Function. Journal of Applied Econometrics, 11, 633–648.

Source: AER R Package HousePrices Object. Christian Kleiber and Achim Zeileis. (2008). Applied Econometrics with R. Springer-Verlag, New York.